The United States has introduced a sweeping new series of reciprocal tariffs, a move that is set to redefine how the country engages with key trading partners. Aimed at addressing long-standing trade imbalances and what the administration describes as “unfair trade practices,” these tariffs mark a significant pivot in U.S. economic policy and could carry long-lasting implications for the global economy.

A New Era of Trade Policy

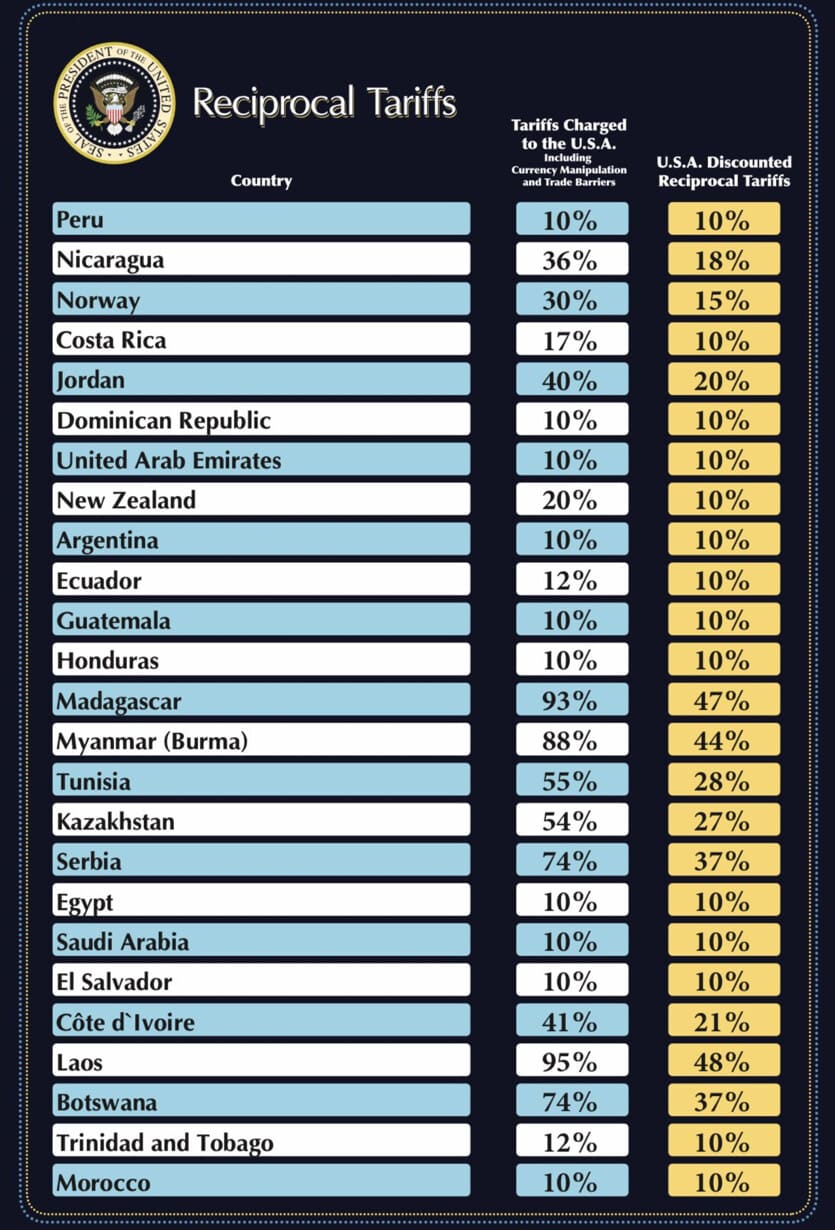

The concept of reciprocal tariffs isn’t new. It stems from the idea that if one country imposes higher tariffs on U.S. exports, the U.S. should match those rates on that country’s imports. The latest policy package, however, takes this principle further. Rather than targeting specific sectors or goods, the administration now aims to broadly equalize tariff rates on a country-by-country basis.

This shift is being sold as a corrective measure. Proponents argue that for too long, U.S. exports have faced punitive tariffs while imports entered the U.S. market with minimal restrictions. The new policy seeks to “level the playing field,” particularly with countries like China, India, and members of the European Union, whose average tariffs on American goods have exceeded U.S. import tariffs.

Who’s Affected?

The new reciprocal tariffs touch several high-impact sectors, including:

- Automobiles and parts

- Steel and aluminum

- Pharmaceuticals

- Agricultural products

- Technology and electronics

Each of these industries is deeply embedded in global supply chains, meaning the repercussions will extend far beyond bilateral trade relationships. For example, U.S.-based auto manufacturers that rely on foreign parts may see increased costs, which could be passed on to consumers. Conversely, U.S. farmers might benefit if trading partners reduce their tariffs to maintain access to the American market.

The International Response

Early responses from other nations have ranged from cautious optimism to outright condemnation. The European Commission has called for “constructive dialogue” to avoid a new wave of trade wars, while Chinese trade officials labeled the move “economically coercive.” Several countries have already signaled that they may retaliate with tariffs of their own if their exports are significantly affected.

Trade alliances like the World Trade Organization (WTO) are watching closely. The policy may challenge existing trade agreements, particularly those that stipulate “most-favored-nation” treatment, where a country must offer the same trade terms to all WTO members. The legality and long-term sustainability of the U.S. approach may soon face international arbitration.

Domestic Reactions: Divided Opinions

Within the U.S., the reciprocal tariff policy has ignited a fierce debate. Supporters—particularly in manufacturing-heavy states—praise the policy as long overdue. They argue it will incentivize domestic production, reduce reliance on imports, and restore lost jobs.

Critics, however, warn of rising costs for businesses and consumers alike. Importers may be forced to raise prices, triggering inflationary pressures in an already sensitive economic environment. Small and mid-sized companies, which often lack the bargaining power of large corporations, could be disproportionately affected.

Economists are also raising red flags. The Peterson Institute for International Economics, for instance, released a report estimating that reciprocal tariffs could cost the U.S. economy billions in lost GDP over the next decade if retaliatory measures are enacted.

Long-Term Strategic Goals

Beyond immediate economic concerns, the new tariff policy is part of a broader geopolitical strategy. It aligns with efforts to reshore critical industries and de-risk supply chains—especially in areas like semiconductors, green energy technologies, and pharmaceuticals.

The administration hopes that this move will encourage allies to follow suit in creating a more balanced global trade framework. However, whether this approach leads to cooperation or further fragmentation remains to be seen.

Some analysts believe the U.S. is positioning itself for a more self-sufficient economic future, preparing for an era of regional trade blocs rather than global trade interdependence. If this is true, reciprocal tariffs may be just the beginning of a larger shift toward trade nationalism.

Potential Future Impacts

The ripple effects of this policy may not fully materialize for several years, but some likely outcomes include:

1. Redefined Trade Alliances

Countries may seek to forge new alliances or strengthen existing ones to offset their reduced access to the U.S. market. This could lead to a reshaping of global trade maps, with emerging markets taking on more prominent roles.

2. Inflation and Price Shifts

Depending on how widely the tariffs are applied, prices on imported goods may rise—especially in sectors like electronics, vehicles, and household goods. While this could incentivize domestic production, it may also stretch consumer budgets.

3. Innovation and Supply Chain Adaptation

Companies may accelerate investment in automation and domestic infrastructure to mitigate rising import costs. Innovation hubs may see new growth as firms race to localize production and reduce reliance on tariff-exposed supply chains.

4. Increased Geopolitical Tensions

If the policy escalates into full-scale tariff battles, it could worsen U.S. relations with major powers like China or the EU. In extreme cases, trade disputes may spill over into other areas, including cybersecurity, technology standards, and military posturing.

Conclusion

The new U.S. reciprocal tariffs represent a major recalibration of trade policy, rooted in the principle of fairness but fraught with risks and global consequences. Whether this initiative fosters greater equity or triggers new economic conflicts will depend largely on the response of international partners and the flexibility of global supply chains.

One thing is clear: we are entering a new chapter in economic diplomacy, and the world will be watching.

Leave a Reply